It has been noted that Mathematical Sciences have a critical role to play in solving complex challenges faced globally. Such challenges are significant in Africa. Indeed, a few young people pursue mathematical sciences careers. Socio-economic factors, lack of mentoring and role models are some of the reasons given for the low participation in Mathematical Sciences. Role models in Mathematical Sciences play a key role in shaping young emerging graduates, academics and researchers’ careers. They may share their skills, knowledge, career progression, obstacles encountered, and the associated lessons learned. Furthermore, they may share career opportunities that aspiring mathematical scientists may benefit from.

For AIMS, role modelling is an important tool for building a pipeline for future mathematical scientist leaders and innovators who may find solutions to global challenges. In August 2020, AIMS House of Science launched a fortnightly webinar series – Après-Lunch with the mathematical scientist webinar series – a platform for the graduate students to engage with inspiring mathematical scientists/role models in academia/industry and other sectors. Our speakers normally share their career journeys with participants, followed by Q & A discussion. The theme for the webinars is Career Advancement in Mathematical Sciences: Achievements, Challenges & Opportunities in Africa”

The first webinar was held on 19 August 2020. The webinar featured Mr Robin Msiska, AIMS South Africa Alumnus (Class of 2016), who is currently working as an AI Engineer in the research and development branch of AWL Inc./AI Tokyo Lab in Tokyo, Japan. After AIMS, in 2019, he completed a Master of Science in Materials Chemistry and Engineering at the Hokkaido University in Japan. He then moved to AWL Inc. a company, which is focused on developing AI camera solutions for other major companies within Japan.

“Working for this company has rapidly improved my understanding of the emerging field of artificial intelligence and computer vision”, he said.

Mr Msiska shared the critical career benefits of being trained at AIMS with the audience. Among those benefits, he mentioned the world-class education, networking opportunities and continuous support. He added:

“The concentration of information, researchers, top tier scientists and other high ranking personnel I met at AIMS is still unmatched”.

Mr Msiska described AIMS as his ‘academic safety net’. He encouraged the audience, particularly current students, to take advantage of network opportunities and resources provided by AIMS:

“Regardless of the intensive schedules, sleepless nights, whatever chance you get, network and establish connections because after AIMS some of these connections come in handy not just for writing you a letter of recommendation but for planning your next step in life. Reach out to alumni, such as myself, for help.”

In his free time, Mr Msiska dabbles in digital art projects.

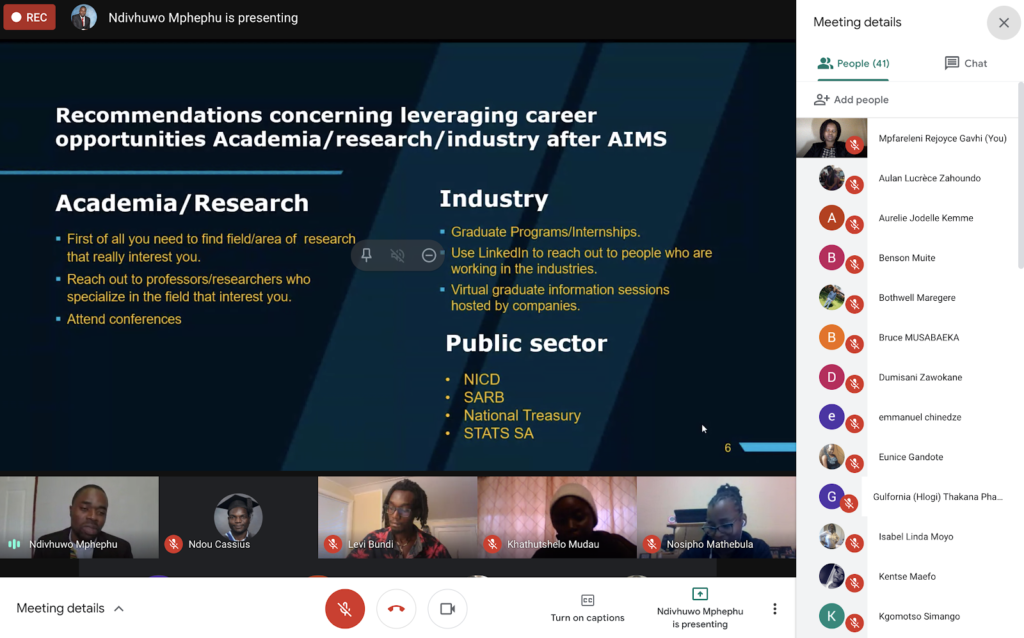

The second webinar was held on 2 September 2020. The webinar featured Mr Ndivhuwo Mphephu, AIMS South Africa Alumnus (Class of 2013 – first South African intake). He is currently working as a Quantitative Risk Analyst at the South African Reserve Bank (SARB). After AIMS, in 2015 he joined the University of Venda as Junior Lecturer in the Department of Mathematics. Recently, he completed his MSc in Financial Engineering from WorldQuant University. Growing up in Budeli village in the Limpopo Province, Mr Mphephu’s passion for Financial Mathematics started during his study at AIMS, after being introduced to several courses in Mathematical Finance. At SARB, he is responsible for the development and validation of credit risk models for regulatory capital calculations under the Advanced Internal Rating Based (AIRB) approach. During his presentation, Mr Mphephu shared some of the challenges in relation to the field of Mathematical Sciences within the (South) African Academia/research:

“Many of those entering teaching have less than optimal mathematical background and don’t have the passion to teach”, he said

“Much of the population, especially from disadvantaged areas, is not aware of the enormous role mathematics plays in modern day society, its role in innovation, its role in other professions, its role in the economy, and the need for mathematical skills in most careers”.

In relation to the primary challenges that AIMS Alumni face after graduation, Mr Mphephu pointed to the inadequate planning for life after AIMS and the under utilisation of AIMS resources:

“Once you get to AIMS, you have all the support and resources that you need for your career progression.…. most people including myself do not plan for a Post-AIMS career journey and do not leverage the available resources at AIMS. For example, apply for the bursaries and establish a connection with international researchers and academics who visits AIMS”.

The third webinar was held on 16 September 2020. The webinar featured Prof Hopolang Phillip Mashele, a Financial Mathematics Expert at the Centre for Business Mathematics and Informatics, North-West University, and a Part-time Senior Researcher at AIMS South Africa. After his PhD in Mathematics from the University of the Witwatersrand, he became a Postdoc fellow at the Alfred Renyi Institute of Mathematics in Budapest, Hungary. He has four-and-a-half and more that 20 years’ experience in the investment industry and as a lecturer in Mathematics and Financial Mathematics, respectively. Prof Mashele is currently working as a model developer for the Microeconomic and Financial Management Institute of Eastern and Southern Africa (MEFMI).

“My interest was initially in the field of Approximation Theory, a research niche in pure Mathematics but my focus has since moved to the field of Financial Mathematics, particularly, financial model development and financial risk analysis”.

According to BankSETA, Financial Mathematics is one of the scarce skills in South Africa and in the whole of Africa. However, there are plenty of opportunities. During his presentation, Prof Mashele shared opportunities available to graduates students who would like to pursue careers in Financial Mathematics in South Africa:

“Traditionally, the investment companies, banks, hedge funds, insurance companies, corporate treasuries…apply the methods of financial mathematics to such problems as derivative securities valuation, portfolio structuring, risk management, and scenario simulation”, he said.

He also shared challenges that students need to be aware of:

“You will never be employed anywhere if you are not a “complete” Financial Mathematician. Theory is not enough. You need to have knowledge of financial markets and be able to program in Matlab or Python or R or SAS”.

“Industry, as a mathematician, you need to know how to communicate your mathematics results to your Manager. As a mathematician, correct solutions are expected from you”.

If you would like to speak in our future Après-Lunch with the mathematical scientist webinar contact Dr Rejoyce Gavhi-Molefe at houseofscience@aims.ac.za